Now, their collective impact crystallizes into one defining number—your ending retained earnings. Calculating the ending retained earnings solidifies your company’s financial narrative, reflecting both past decisions and setting the stage for future investments or debt management. It’s a number that tells a story, so make sure it’s penned with precision and clarity. When you subtract dividends from your net income, you’re essentially closing the loop of your retained earnings calculation. It’s a subtraction that underscores a company’s generosity and investor-centric https://rmtextile.com/4-7-closing-entries-business-libretexts/ ethos or highlights a strategic choice to harness profits for growth. To kick things off with preparing a statement of retained earnings, you start with a sprint down memory lane – the beginning balance.

What does the statement of retained earnings include?

- This agreement outlines the proportion of profits (or losses) each partner is entitled to.

- The key to a successful internal reinvestment strategy is to identify sectors within the business with the highest potential for growth and allocate resources accordingly.

- Don’t forget to record the dividends you paid out during the accounting period.

- The discretionary decision by management to not distribute payments to shareholders can signal the need for capital reinvestment(s) to sustain existing growth or to fund expansion plans on the horizon.

- By carefully examining the statement of retained earnings, investors can gain valuable insights into a company’s performance, financial health, and strategic priorities.

It provides a historical perspective on how a company has managed its profits, offering a comprehensive view of its financial trajectory. From a more cynical view, even positive growth in a company’s retained earnings statement retained earnings balance could be interpreted as the management team struggling to find profitable investments and opportunities worth pursuing. The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net income minus dividends.

- Retained earnings are the total profits a business keeps to reinvest rather than distribute as dividends.

- However, note that the above calculation is indicative of the value created with respect to the use of retained earnings only, and it does not indicate the overall value created by the company.

- Whether you’re preparing for investor meetings or simply want to improve internal reporting, mastering this document is a smart step toward sustainable growth.

- Spend less time figuring out your cash flow and more time optimizing it with Bench.

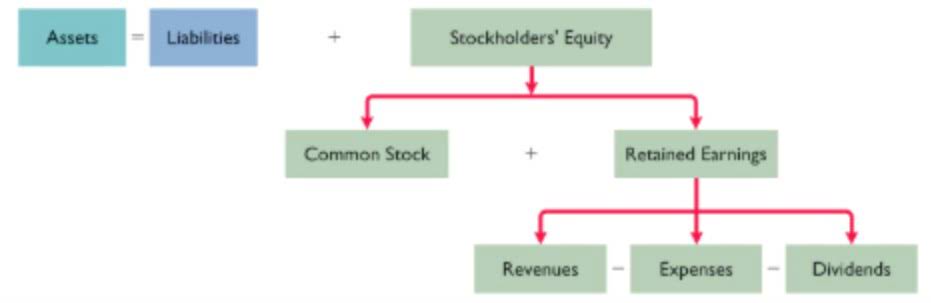

- This ending balance appears as a component of stockholders’ equity on the Balance Sheet.

- This statement details the company’s revenue, expenses, and net income over a specific period, providing insights into its profitability.

Financial software that helps you run your business and pay your team better.

They increase with a credit entry, and retained earnings decrease with a debit entry. Retained earnings often enjoy a reputation as a marker of a company’s wealth, but grab your myth-busting gear because it’s not quite the financial fortress it’s rumored to be. Understanding this helps them see the full financial picture and keeps expectations about dividend policies and company valuation in check. In essence, retained earnings are a reflection of your company’s success story and foresight. They suggest a trajectory that piques the interest of those looking to invest in a company on the upswing.

Setting up a Statement of Retained Earnings

It’s a narrative you write with care, knowing each chapter influences the future of the company. Once you’ve settled on the starting line with the beginning balance, you’re ready to turn up the heat with the core element of retained earnings balance sheet – your net income (or sometimes, alas, the net loss). Visualize this process as setting the stage before the hustle and bustle of business activities come into play, ensuring that the starting line is clearly marked. The beginning balance is your financial anchor, and from here, you’ll navigate through the fiscal ebbs and flows to chart the course of your retained earnings.

- The change in accounting policy for depreciation results in a decrease of $8,000.

- Take Apple Inc. (AAPL) as an example; its stock price increased from about $28 to about $112 per share from September 2016 to September 2020.

- The statement of retained earnings provides insights into how a company reinvests its profits back into the business or distributes them to shareholders as dividends.

- Over time, it shows the company’s accumulated profits that are reinvested in the business.

- If your company is very small, chances are your accountant or bookkeeper may not prepare a statement of retained earnings unless you specifically ask for it.

However, they might consider making dividend payments to the shareholders for the financially healthy entity based on their approval. This is part of the investment strategy that making dividend payments could retain the investors and attract more potential investors. This statement might also show the adjusting transactions made during the year and the effect on retained earnings. This statement tied the income statement and balance sheet through net income made during the year. The entity may not prepare this statement, but they may use the statement of change in equity and balance sheet instead. Evaluating these changes alongside industry benchmarks enhances your understanding.